How Much Is Your Website Worth?

A Beginner’s Guide to Online Business Valuation

Whether you’re running a niche blog, content site, or affiliate business, one question eventually comes up: how much is my website actually worth? Understanding your site’s value can help you make better decisions – whether you’re preparing to sell, attract investors, or simply want to grow smarter.

This guide breaks down the basics of website valuation so even first-time founders and side hustlers can get a clear picture of what their digital asset is worth.

Why Website Valuation Matters

Knowing what your website is worth isn’t just about planning an exit – it can shape how you grow your business.

It helps you:

- Benchmark performance

- Uncover growth levers

- Spot opportunities to increase value

- Get realistic when it’s time to sell

💡 CONTENT STRATEGY TIP Understanding your site’s value helps you prioritize which content types and topics drive the most revenue. Focus your content strategy on what actually moves the needle for your bottom line.

A well-prepared seller can often command a significantly higher price simply by knowing what buyers care about and positioning their site accordingly.

How Are Websites Valued?

While there are various complex formulas used to determine the value of an online business, the most common and straightforward approach relies on an Earnings Multiplier. This method typically values a website at 2 to 3 times its annual net profit.

So, for instance, if a site earns $150,000 in yearly profit, its estimated value might fall between $360,000 and $450,000.

Keep in mind, though, this is a simplified approach meant to offer a ballpark figure. A more accurate valuation requires a deeper look at other factors that influence the true value of the business.

Factors That Influence Website Value

A website’s value isn’t just about numbers, it’s also shaped by how buyers perceive risk and return. Flippa, the leading platform to buy and sell online businesses, offers numerous resources for online business owners to understand and increase the value of their business.

Based on Flippa’s marketplace insights and real world data, let’s talk about the five essential elements that play a major role in determining how much your website might be worth.

1. Profit Margins

The core driver of a website’s valuation is its profitability.

Flippa uses the Seller’s Discretionary Earnings (SDE) method, which calculates net profit after removing taxes, one-off costs, and owner salaries over the previous 12 months.

Revenue alone doesn’t tell the full story. High operating costs can eat into profits and lower a business’s value.

Profit margins for websites can vary by business model: affiliate sites can reach margins of 70 to 80%, whereas eCommerce businesses tend to operate around 20 to 30%.

Ultimately, higher consistent profit means a higher valuation.

📊 FSG INSIGHT Content sites with strong SEO foundations typically command higher valuations because organic traffic has lower acquisition costs than paid traffic. This is why we focus so heavily on SEO-optimized content strategies.

2. Traffic & Audience

Traffic quality and source matter just as much as volume.

Sites dependent on paid ads often have higher costs and thinner margins. On the other hand, those that generate organic traffic, typically through SEO, enjoy lower acquisition costs and steadier returns.

3. Monetization Model

How your site makes money plays a big role. Common models include:

- Display ads

- Affiliate marketing

- Digital products or services

- Subscriptions or membership

A business with multiple income streams is generally more valuable than one relying on a single revenue source.

For example, content sites may earn through a mix of ad networks and affiliate programs. eCommerce businesses might operate both a Shopify store and an Amazon FBA channel.

If a business relies too heavily on one method, like a single affiliate program or ad network, any disruption could hurt earnings significantly.

Revenue diversification improves resilience and, in turn, boosts valuation.

🎯 CONTENT STRATEGY CONNECTION Diversified monetization starts with diversified content. Create content that supports multiple revenue streams – educational posts for affiliate marketing, entertaining content for ad revenue, and valuable resources for email list building.

4. Niche & Growth Potential

Evergreen niches like personal finance or fitness are typically more valuable than short-lived trends. Buyers also evaluate how competitive the market is. Saturated niches may lower appeal unless the business has a clear edge.

Buyers can potentially evaluate value on questions like:

- Is there room to grow the site further?

- Has the business already peaked?

- What investment would be needed to scale?

A niche with steady demand, moderate competition, and clear growth opportunities will significantly boost your site’s valuation.

5. Transferability

A digital business is still a business, and buyers want an easy handover. The simpler it is to take over operations, the more valuable the site becomes.

Key things buyers look for:

- Are supplier/vendor contracts easy to transfer?

- Are there clear SOPs or systems in place?

- Is the site built on a common platform?

- Do customers engage with the brand?

Fewer handover hassles mean more buyer confidence and a higher potential sale price.

📝 DOCUMENTATION TIP Start documenting your content creation process, editorial calendar, and content performance metrics now. Well-documented content systems significantly increase your site’s transferability and value.

Real-World Valuation Tips

Based on 15 years of transaction data on Flippa and exclusive insights on buyer behavior, here’s how you can set your website apart and command a higher value:

- Have clean, documented financials and SOPs.

- Document 12 to 24 months of consistent income.

- Focus on growing or maintaining stable traffic trends.

- Develop quality content and have a strong SEO foundation.

- Try to have diverse monetization or traffic channels.

- Invest in professional branding and improving the overall UX.

Sites with declining revenue, thin content, or heavy owner involvement may see reduced interest or lower offers.

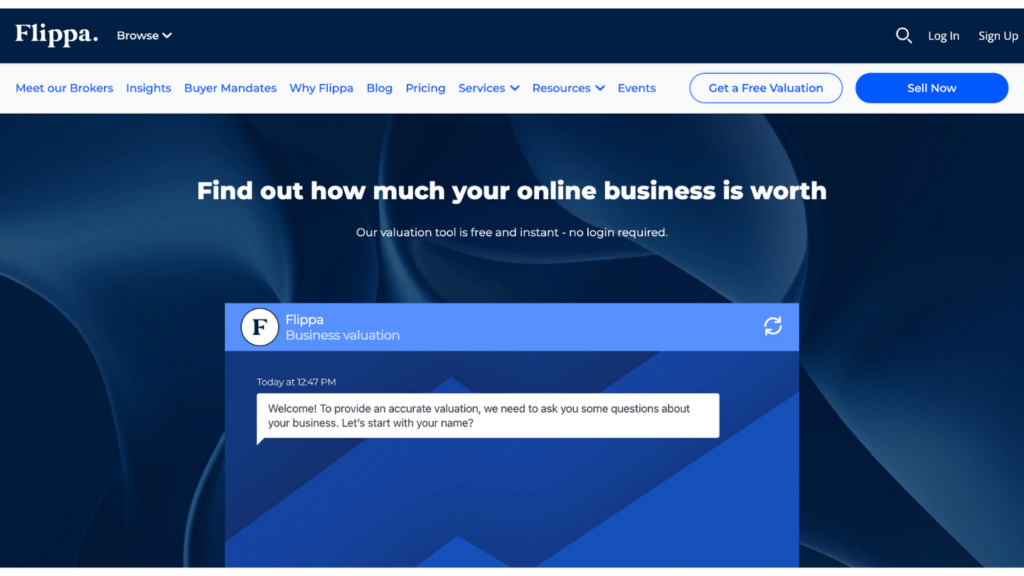

Tools to Estimate Your Website’s Value

Flippa offers a Free Valuation Tool that uses real marketplace data – like recent sales of similar sites, traffic, revenue, niche, and growth trends – to estimate your site’s value in minutes.

If you’re curious about your own site, start with a free valuation or browse similar sites on Flippa to benchmark.

How to Increase Your Website’s Value

If you’re planning to sell your website now or in the near future, here are ways to boost your valuation over time:

- Optimize revenue per visitor (e.g., using higher-paying affiliate programs or premium ad networks)

- Add new revenue streams to reduce dependency on one source

- Build an email list or online community to boost engagement

- Investing in evergreen SEO content to drive long-term traffic

- Outsourcing or systemizing key tasks to make the business less dependent on you

These small improvements can significantly improve your exit price or just make your site more profitable while you own it.

⚡ QUICK WIN Want to create content that actually builds your site’s value? Our strategic content approach helps you focus on topics and formats that drive real business results – not just traffic. Get our free content strategy guide to start building more valuable content today.

Final Thoughts: Your Website Is an Asset

Even a side hustle or small niche blog can be worth thousands, or more, if structured well. The earlier you understand valuation, the easier it is to grow with intention and exit smartly.

When you’re ready to sell, the more prepared you are, the better (and profitable) the outcome will be!

Frequently Asked Questions

Most websites are valued at 2-3 times their annual net profit using the earnings multiplier method. However, factors like traffic quality, monetization diversity, niche stability, and transferability can significantly impact this multiple.

Buyers value websites with consistent organic traffic, diversified revenue streams, documented processes, evergreen niches, and minimal owner dependency. Sites with strong SEO foundations and multiple monetization methods typically command higher prices.

Document at least 12-24 months of consistent income before considering a sale. This demonstrates stability and helps buyers feel confident in the business’s sustainability.

Website valuations are based on profit (Seller’s Discretionary Earnings), not revenue. A site earning $100,000 in revenue with $80,000 in expenses is worth much less than one earning $60,000 in revenue with $10,000 in expenses.

While building long-term value takes time, you can make improvements like optimizing revenue per visitor, diversifying income streams, documenting processes, and improving SEO to boost valuation within 6-12 months.

Evergreen niches like personal finance, health and fitness, technology, and education typically command higher valuations due to consistent demand and growth potential. Trend-based niches may be less valuable due to uncertainty.

Prepare by documenting all processes, organizing financial records, ensuring consistent traffic and revenue trends, diversifying income sources, and reducing your personal involvement in day-to-day operations.

Flippa offers a free valuation tool that uses real marketplace data to estimate your site’s value based on traffic, revenue, niche, and recent comparable sales.